A few suggestions to correct the continuing over-supply problem

In February 2020, I wrote a tongue-in-cheek article about the intersection of human composting and cannabis.

At the time, Massachusetts cannabis licensing was moving at a slow crawl; despite the law requiring that applications be processed within 90 days, the Cannabis Control Commission (CCC) would often not review applications for up to eight months before declaring the application complete and starting the 90-day clock.

Human composting, which is legal in six states with Mass on the potential legislative horizon, is a very cool concept, and I figured that companies with leases on big cultivation spaces could explore the side business of green burials if cultivation became uneconomical.

Today, however, CCC applications are processed much more efficiently. Still, in revisiting my article on human composting from two years ago, I was struck by a few of the cannabis licensing figures.

As of Jan. 29, 2020, the commission’s open data platform reported that 91 cultivators had achieved a provisional or final license for 1.8 to 2.5 million square ft. of canopy. Canopy licenses are in bands with a low end and an upper limit, hence the range. Behind those 91 licenses sat 124 pending applications. We performed some quick math and determined that if those 124 applicants have an average canopy like the then existing 91 cultivation licensees, once all of those facilities became operational, the state’s canopy would reach 4.4 and 6.1 million square ft.

In 2020, the commission did not disclose canopy size for provisional license applicants. But in analyzing numbers from a CCC meeting last December, I was struck by some of the similarities to the January 2020 data.

As of Dec. 8, 2022, 95 cultivators were operational, licensed for 2.1 to 2.86 million square ft. of canopy. Behind them are 24 final licenses approved for 570,000 to 765,000 square ft. of canopy (over half of these licenses are tiers 1, 2, or 3), while 180 provisional licensees are seeking approval for 3.6 to 4.975 million square ft. of canopy.

What does this all mean? After nearly three years—January 2020 to December 2022—cultivation has gone from 91 provisional / final licensees to 95 operational cultivators. Clearly, early predictions that the state would need 8 to 11 million square ft. of canopy were greatly overblown. We acknowledge the counts are not direct apples to apples but believe the groupings are relevant.

The market is currently oversaturated with cultivation capacity and because aspiring marijuana entrepreneurs tend to forsake market research, the applications keep coming. I met with a town manager last week to discuss a microbusiness opportunity and they casually mentioned they just had a discussion with a team seeking to open a cultivation facility. When I stated that prices were crashing and suggested there was too much cultivation capacity, the manager was unphased. I believe they saw the dollars from community impact fees to be far more attractive than a business opening that was likely doomed to fail.

All things considered, I put together some thoughts on what can be done to remedy the oversupply and how operators can contribute.

1 – Publish statistics to guide demand planning

My sense from discussions with many cannabis entrepreneurs is that very few, if any, are conducting market research. And that statement is not limited to Massachusetts.

In mid-November, I explored the free giveaway of a store in Massachusetts. The article dove into some assumptions and determined that the subject store would need to reach $5.9 million of revenue to cover its rent and break even. While the landlord was rumored to be willing to provide some limited level of rent reduction, that store would still need to materially increase its revenues above its existing ~$1.5 million annual revenue.

Through a public information request we learned that total sales of legal adult-use cannabis have been dropping and that the current sales level in that municipality is below $5 million. The town where an operator is trying to give a store away has three dispensaries, and it’s unlikely that the store in question can reach a meaningful level of profitability. We could be wrong, but our gut instinct is that the buyer has not bothered to conduct market research. For some odd reason, cannabis operators just don’t believe in doing so.

Several years ago, I analyzed the Massachusetts market and determined statewide sales would likely reach $2 billion. In fact, had prices not crashed, 2022 likely would have hit close to that target. As a social equity trainer for the state, we encouraged participants to conduct market research. The vast majority had limited to no interest and often informed me they would be fine as they were planning on producing small craft batches. When I suggested they were not selling into a $2 billion market, but more likely a $60 million market, since the upper end for premium products is likely closer to 3% of the market versus the likely 70% devoted to mass market run-of-the-mill products, the conversation often ended with blank stares.

It is time to create a focus on data and demand planning. The CCC has data on hand and should be publishing monthly statistics on current statewide production capacity, how much canopy space has been licensed and is operational, how many plants are being reported in that canopy space, and, based upon past local industry performance, average yields to be expected from those plants. The regulator could also disclose how many square feet of canopy have been applied for and have (a) reached a provisional license but not a final license, and (b) have submitted an application but have not achieved a provisional license yet. The goal is to understand how much flower or flower-equivalent products are being sold, how much is being produced, and how close (or far) from equilibrium the market is.

What you can do: Contact the commission and request they publish data that will serve this purpose, at least monthly, if not weekly until market conditions stabilize.

2 – We need more data geeks

The commission cannot do this on its own. They need assistance from the industry. The commission could offer courses on their data platform. Most other data geeks I speak with concur that the open data platform is not very user friendly.

How about a series of courses at the commission’s headquarters? Such a program could combine instruction with exercises and create a few teams within the class to develop a few models to address some data questions.

3 – Enforce the 70% rule

3 – Enforce the 70% rule

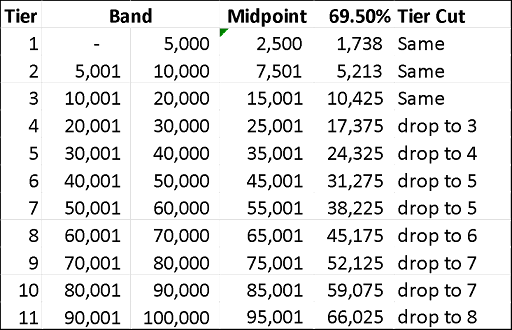

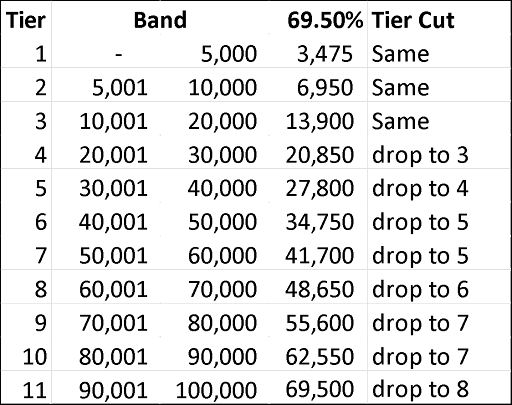

The initial commissioners likely had an inkling there could be capacity issues and built into the regulations the ability to reduce canopy limits. Section 500.050(2)(d) of the regulations provides that “The Commission may reduce the Licensee’s maximum Canopy to a lower tier if the Licensee sold less than 70% of what it produced during the six months prior to the application for renewal …”

Think about that. If a cultivator had a limit of 100 and didn’t sell at least 70, their canopy limit can be reduced. That cultivator would need to increase sales by over 42% to get back to 100 if their new base was 70. That is a big increase and to miss the sales mark by 30% is also a big gap.

There was a concern expressed at the commission meeting that cultivation tiers 1, 2, and 3 comprise the largest concentration of licenses and reducing their canopy could put them out of business. We calculate that the 56 licenses in the three lower tiers account for 56.6% of all operational cultivation licenses, but just 18.4% of the canopy (using the midpoint of the canopy tier range). Meanwhile, the 11 licenses in the three greatest tiers account for 11.1% of all operational cultivation licenses, as well as an outsized 39.5% of the canopy. It is likely the larger cultivators that are driving the excess capacity and enforcing the 70% rule will have a far less impact upon the lower tier operators.

To better understand this conundrum, we analyzed the impact of each licensee operating at the very top of their tier and selling only 69.5% of their production. Notice in the accompanying table that if sales were 69.5% of the upper range of the canopy tier, the lower three tiers would not suffer a tier reduction. The big reductions would impact the larger tier cultivators. The analysis is consistent, even if we used the midpoint of each tier.

Enforcing the 70% rule will likely not hurt the smaller cultivators and could help them. Under current conditions, numerous cultivators will fail by the end of 2023. Reducing canopy increases chances for survival—and not just for the most well-funded operations that can weather the storm and outlast the little guys. (Based on comments at the Dec. 8, 2022 CCC meeting—scroll to 44 minutes in—it does not appear the commission is enforcing the 70% rule.)

Enforcing the 70% rule will likely not hurt the smaller cultivators and could help them. Under current conditions, numerous cultivators will fail by the end of 2023. Reducing canopy increases chances for survival—and not just for the most well-funded operations that can weather the storm and outlast the little guys. (Based on comments at the Dec. 8, 2022 CCC meeting—scroll to 44 minutes in—it does not appear the commission is enforcing the 70% rule.)

I haven’t seen the books of cultivators, but as Zack Huffman reported in early November, several Boston law firms are busy handling cannabis restructuring engagements. It would not be surprising to learn that cultivators are maintaining production in hopes of generating the necessary cash to service their investors. Eventually, the merry go round will stop though, and with devastating results.

As I wrote in February 2020: “When supply and demand finally come into balance, there will be a backlog of applications to be processed, licensees building out facilities where they have yet to start growing, and new grows that have not reached their first harvest. And if that happens, just like the federal government typically calls a recession about eight months after one starts, the markets won’t realize supply and demand are in equilibrium until at least a year after it happens. Over-capacity seems inevitable.”

It’s time to enforce the 70% rule.

What you can do: Call and email the CCC, speak with commissioners at conferences, and make your position known regarding the 70% rule.

4 – Place a time limit on provisional licenses

Once one achieves provisional license status, as long as they pay the annual license renewal fees, they have that license forever. If a licensee fails to pay the renewal fee, they can cure that failure at a later date. This creates a huge shadow market, as there are many more provisional licenses than final licenses.

Municipalities are now routinely requiring operators to be operational within a certain period of time or their local operating approval (the host community agreement, or HCA) terminates. Maybe it is time for the commission to take similar action. If a prospective operator has not shown material progress (which must be defined), they should not be allowed to renew. If a prospective operator cannot achieve a final license application within a set time frame (18 months, for example), their license should expire. Obviously, allowances must be made for operators constructing new buildings, but there needs to be time limits on the lifespan of provisional licenses.

I looked at existing cultivation licenses that were (a) operational, and (b) unexpired. We found that on average, from provisional approval to final approval required 151 days with a low of 27 days and a high of 340. If we eliminate all results between 135 days (10% below the average) and 165 days (10% above the average), there were only six outliers. That seems to infer a high confidence level that provisional licenses that are over a year old are unlikely to achieve a final license. More analysis is needed, but a time limit might help the market understand production capacity and lead to better demand planning.

5 – Enact a cultivation license moratorium

There has been a lot of discussion about such an approach. It is a protectionist policy that protects existing cultivation licensees at the expense of those trying to enter the legal market. But the commission could limit new licensees to a 20,000 or 30,000 square ft. canopy until they prove they can sell at least 100% of their production before requesting an increase.

The commission could also require applicants to acknowledge the current market statistics as to demand levels and existing production capacity. And could also require that all investors acknowledge they are aware of those statistics. Forcing that issue to the top of the pile could in and of itself cause a reduction in applications. We have no data to support this contention but believe the lack of published data is encouraging emotionally-driven decisions as opposed to data-based ones.

6 – Doing my part

While it requires a bit of data digging, analysis, and thought, preparing these articles is not a heavy lift. I enjoy what I can learn from analyzing the data. As I pondered the list above, I realized the final link in this chain to pull the local cannabis industry out of the mud is an industry-only buyer’s show. Exhibitors are limited to firms that are licensed and sell their products B2B (cultivators and manufacturers). Attendees are limited to buyers from firms that are licensed and buy their products B2B (retailers, manufacturers, and delivery operators—the delivery class license that operates like a mini Amazon versus the courier that operates like UBER Eats or DoorDash). A show of this nature should help participants in the supply chain make deals and start to move their excess inventory.

If you’re a Massachusetts licensee, block out the tentative date of Tuesday April 25, 2023. If you want to know more, connect with me on LinkedIn. We will make our final Go/No-go decision at the end of the first week of February, but a show of this nature is critical to clearing excess product from producer’s inventory.

These are just a few suggestions to cure the over-supply problem. Massachusetts and Michigan may be deep in the midst of it, but rest assured, New Jersey, New York, and Connecticut are not very far behind.

As the old saying goes, “Good judgment comes from experience and experience comes from bad judgment.” When it comes to cannabis businesses, we have an opportunity to accumulate good judgment from somebody else’s experience.