Are we equitably reinvesting cannabis revenue in communities harmed by the war on drugs?

The following is part of a letter written by the policy team at Equitable Opportunities Now, a nonprofit that “educates and empowers people of color to become active participants in the Massachusetts legal cannabis market,” to state lawmakers who are currently considering multiple critical cannabis bills. This part of their testimony addresses EON’s research on where Mass cannabis tax revenue is going and whether the state is equitably reinvesting in communities harmed by the war on drugs. We also published their statement on barriers to equitable participation and the promotion of businesses owned by and career pathways for justice-involved individuals here. -TJM Editors

When amending the voter-approved Ballot Question 4, the Legislature took an important first step in creating a framework for reinvesting cannabis tax revenue for social justice, writing:

“Money in the fund shall be subject to appropriation. Money in the fund shall be expended for the implementation, administration and enforcement of this chapter by the commission and by the department of agricultural resources for the implementation, administration and enforcement of sections 116 to 123, inclusive, of chapter 128 and the provision of pesticide control pursuant to chapter 132B. Thereafter, money in the fund shall be expended for: (i) public and behavioral health including but not limited to, evidence-based and evidence-informed substance use prevention and treatment and substance use early intervention services in a recurring grant for school districts or community coalitions who operate on the strategic prevention framework or similar structure for youth substance use education and prevention; (ii) public safety; (iii) municipal police training; (iv) the Prevention and Wellness Trust Fund established in section 2G of chapter 111; and (v) programming for restorative justice, jail diversion, workforce development, industry specific technical assistance, and mentoring services for economically-disadvantaged persons in communities disproportionately impacted by high rates of arrest and incarceration for marijuana offenses pursuant to chapter 94C.” (emphasis added)

Five and a half years later, this Committee and the Legislature helped to preserve the Commonwealth’s status as a national leader in cannabis equity by joining six other states (Colorado, Illinois, Michigan, New Jersey, New York, Virginia, and Vermont) that reinvest cannabis tax revenue into capitalizing applicants from communities harmed by the War on Drugs by establishing the Cannabis Social Equity Fund and at last appropriating a portion of cannabis tax revenue to this urgently needed restorative justice program.

The creation of that fund and establishment of a dedicated revenue stream was a crucial beacon of hope for people struggling to enter this industry, yet we already know that it will not be enough – and we know that we can and must do better.

In 2017, when legalization’s impact on public health and safety was unknown and law enforcement was still adjusting to changes in the law, it may have made sense to potentially invest cannabis revenue into the five priorities detailed in the statute. But after six years of experience, it is clear that the impact of legalization has been negligible on law enforcement agencies and behavioral and public health services.

Eighty percent of the cannabis revenue priorities contemplated by statute have not demonstrated a need for significant investments of new revenue. And yet the one-fifth of the priorities that urgently need investment was ultimately only funded with 15% of cannabis tax revenue.

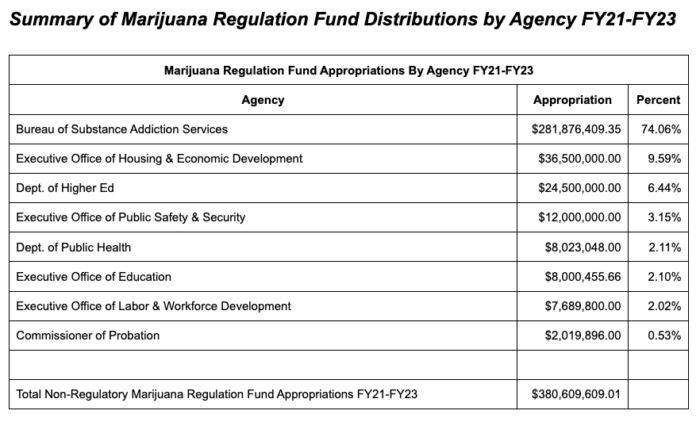

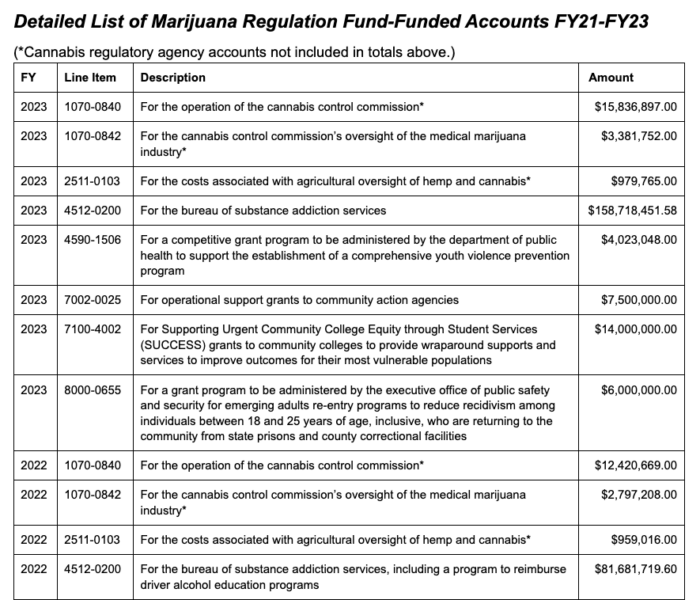

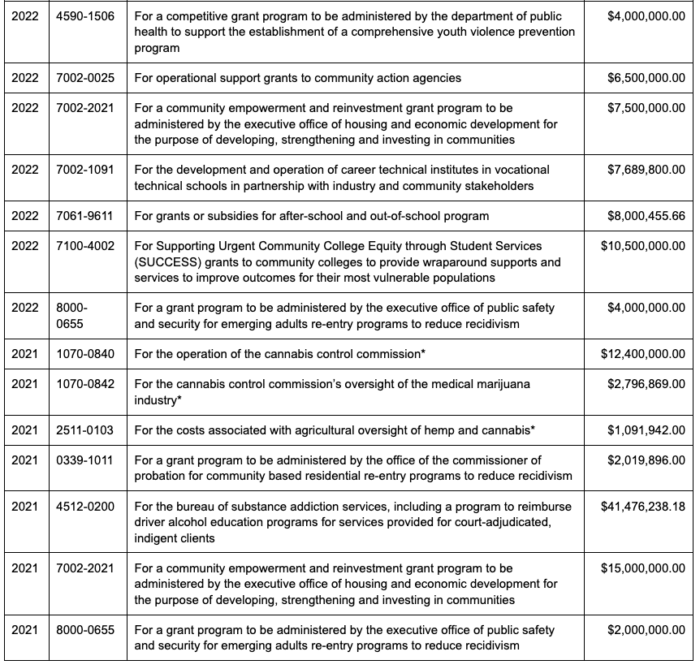

An analysis of the Commonwealth’s FY21, FY22, and FY23 budgets shows that nearly three-quarters of the more than $380,000,000 discretionary spending from the Marijuana Regulation Fund has been directed to supplement existing Bureau of Substance Addiction Services programs, with the remainder going to public health, after school programs, higher education support services, the criminal justice system, and modest community investments.

While the 15% of cannabis revenue dedicated to the Cannabis Social Equity Fund is a promising first step toward making a meaningful investment in restorative justice, a truly equitable allocation would dedicate the balance of all cannabis revenue not necessary for regulation or mitigation back toward the communities most harmed by the war on drugs.

While we recognize that the Legislature has other spending priorities for cannabis tax revenue, we urge you to take two modest steps toward more meaningful – and equitable – distribution of those funds towards restorative justice by updating Section 14(b) of Chapter 94G to:

- Increase the percentage of money in the fund transferred to the Cannabis Social Equity Trust Fund to 50%

- Reflect that after more than half a decade, law enforcement is adequately trained in cannabis laws and that we should prioritize appropriating those funds to community programs rather than the criminal justice system

Two bills filed by Sen. Miranda provide a path for making a meaningful and urgently needed investment that could enable more than three times as many Black and Brown businesses to find opportunity in the Commonwealth’s cannabis industry and help ensure a more equitable appropriation of cannabis revenue in the future.

S56 would update existing law to divest cannabis revenues from law enforcement, and S55 includes that change and increases Cannabis Social Equity Fund funding to 50% of cannabis revenues. We strongly urge you to favorably report these bills and make a meaningful investment in capitalizing economic opportunity for the communities most harmed by the war on drugs before it is too late.

EON is excited to share with that Cannabis Control Commission Chair Shannon O’Brien, Executive Director Shawn Collins, and Commissioners Nurys Camargo, Ava Concepcion, Kimberly Roy, and Bruce Stebbins will join EON to listen in on our Virtual Community Regulatory Review Listening Session on Thursday, July 6 at 1PM. More info here.