The overhyped cannabis company made a lot of news, but from celebrity collabs to political hires, the hollowness was always obvious

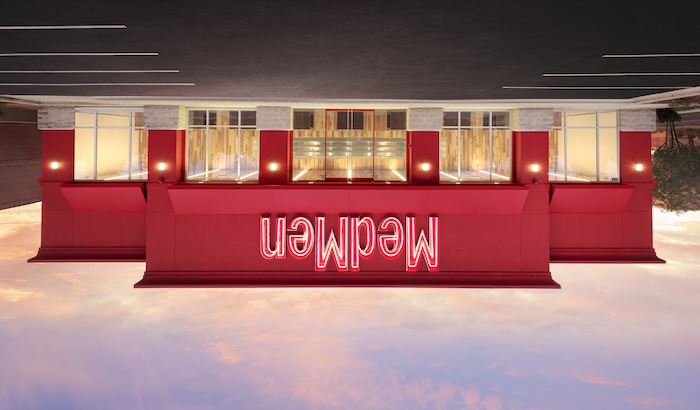

After countless death knells, rescues, revamps, and restructurings, MedMen, once a beacon of cannabis profiteering promise for the third-gen progeny of Gordon Gekko wannabes in preppy shirts with pricey Dunks, filed for bankruptcy protection last week.

The company has more than $400 million in liabilities. Prior to the bankruptcy, MedMen’s subsidiary, MM CAN USA, was placed into receivership in California (the first meeting for creditors is scheduled for May 14).

Prior to the pandemic, the brand-heavy dispensary chain—which has a footprint in the Nevada, California, Massachusetts, Illinois, and New York markets—had a valuation of about $3 billion. You know where this is going—this past January, the stock bottomed out, and here we are.

I’ll spare readers too much of the obvious outrage over how much damage small minds with deep pockets can do to an entire industry. Anyone who’s ever given more than they have taken from the cannabis community should be incensed over the trail of horse shit left in the wake of this visibility disaster. Because that’s who always has to manage all the mess and blowback.

We take pride in highlighting weed businesses that run much differently than MedMen. That is, to say, with respect for cannabis culture, employees, consumers, and, of course, the plant itself. Most mainstream outlets have a different motive, though, and so they threw MedMen a public relations parade.

It’s been obvious to many observers and even MedMen employees and stakeholders for several years that the red baron was in a decadent suicidal spiral. But even before news surfaced about “Lavish Parties, Greedy Pols and Panic Rooms,” the ostensibly positive puff headlines also suggested the investment was hot like the Fyre Fest and bound for comparable Netflix notoriety.

Take, for example, the first piece on our list, a sloppy Vanity Fair handjob which openly considered if MedMen is most like Target, Supreme, Apple, Nordstrom, or Starbucks—all Fortune 500 monsters that the startup’s founders, publicists, or spoonfed interviewers had mentioned at some point.

As it turns out, MedMen couldn’t hold a cup of coffee for those companies, but there were actually two corporations worth drawing comparisons to mentioned in the highly influential 2018 VF dispatch. MedMen Manhattan, the writer noted, is “across the street from the old Lord & Taylor headquarters.”

That building was transformed into a “WeWork flagship,” which “promises something of a built-in customer base.”

The story basically writes itself. With the above sentence, the WeWork cameo, and all the articles below, I bet a decent AI bot could compose a script version for Hulu before Netflix gets its own inevitable rival documentary miniseries off the ground.

Vanity Fair (2018)

L.A. Times (2018)

Former L.A. Mayor Villaraigosa joins board of local cannabis firm MedMen

Los Angeles Business Journal (2018)

MedMen names former Apple retail executive as new CFO

Variety (2018)

Roc Nation’s Jay Brown Joins MedMen Cannabis Company Board

L.A. Times (2018)

L.A. pot retailer MedMen has 12 shops, a $1.6-billion valuation and, coming soon, Canadian stock

The Hollywood Reporter (2019)

Spike Jonze and Jesse Williams Teaming on MedMen Short Film

CNBC (2019)

Top execs at American weed retailer MedMen quit amid ex-CFO’s claims of financial duress

Marijuana Moment (2019)

South Park Slams MedMen In Episode About Banning Marijuana Home Cultivation

Politico (2020)

Lavish Parties, Greedy Pols and Panic Rooms: How the ‘Apple of Pot’ Collapsed

Forbes (2023)

Cannabis Pioneer MedMen Names Fifth CEO In 3 Years As Company Teeters On Brink Of Collapse