The biggest protection will come from how the legislation is designed, and that will be influenced by who has a seat at the table

Read the first installment of this article here

I write about the business of cannabis. At heart, I am an analyst, and the cannabis industry is fascinating. It is the only industry that is illegal at the federal level, legal at the state level, and tolerated by the feds via a variety of non-legislative actions.

I have been writing about this issue for nearly three years, and these days, I’m primarily interested in interstate commerce, the ability to safely ship products across state lines, and how dramatic changes in that realm could impact the industry.

As I wrote in the first installment of this column focusing on interstate cannabis commerce, this industry will turn on a dime when certain events take place. I predict three coming seismic shifts—interstate commerce, as well as decriminalization and legalization. The adaption curve will be short, and the industry could be turned on its head.

In this installment, I’ll specifically address the potential impact of federal decriminalization and legalization.

Federal decriminalization would remove federal penalties but will not mean national legalization. Cannabis will no longer be illegal at the federal level, but it won’t be explicitly legal either.

If interstate commerce hasn’t already happened, federal decriminalization will usher it in together—with a lot of confusion. Think of it like a state of limbo in which transportation will take the form of interstate commerce as described in the prior article. Some may recall how after the 2018 Farm Bill legalized hemp and farmers began to truck it across the country, shipments of hemp were seized by various states. But because they legalized hemp, the feds informed all states that shipments could not be seized—even if the state had not legalized hemp.

Without legalization, similar protections likely won’t be available for cannabis businesses. Some larger companies will see the lack of criminalization as a reason to jump into the market, while others will view the lack of legalization as a reason to remain cautious.

However it happens, decriminalization will give the industry a taste of what’s to come when the legalization gates open. Expect to see more intense competition and different operating methods as larger firms employ MBAs to refine how the businesses operate and create greater efficiencies. These big firms often have greater resources and more bench strength than most existing cannabis companies—imaging competing with experienced and fully-staffed marketing departments with the latest technology to analyze customer purchasing patterns. Everyone will need to be on the top of their game, but the period will serve as a great prep for full legalization.

Federal legalization, of course, is the holy grail that many wish for, even if they do not understand its impact. If you believe the MSOs are the big players and exert too much influence or muscle, you ain’t seen nothin’ yet. Relatively speaking, even the largest current cannabis operators are small compared to the Wall Street crowd.

In August 2018, Constellation Brands, the maker of Corona and Modelo beers, invested $4 billion US in Canadian cannabis company Canopy Growth, then the world’s largest cannabis company by market capitalization, setting off a rocket ride for cannabis stock prices. On July 20, 2018, Canopy Growth’s stock price was $24.21 per share. It peaked at $51.53 on Sept. 7, 2018. By March 13, 2020, it was at $10.94. The price recovered in 2021 but slowly bottomed out at $2.39 by October 21, 2022. Here’s where it is today.

Imagine how big a company must be to blow $4 billion and be able to shrug it off. That is what is waiting on the sidelines with federal legalization, which will involve federal regulations, possibly federal licenses, certainly federal taxes, and more complexity. As one should expect, the alcohol and pharmaceutical industries are already attempting to insert themselves into the process.

Federal legalization will unravel whatever remains untouched from decriminalization. It will open the door to numerous large companies in “vice” industries such as alcohol and tobacco. CVS and Walgreens will likely want to be part of anything related to medical applications, especially if insurance reimbursements are involved. There’s plenty of precedent.

On March 20, 2019, Bloomberg reported that CVS would begin to carry CBD products in 800 of its stores, sending Curaleaf shares soaring. Not to be outdone, on March 27, 2019, CNBC reported that Walgreens would sell CBD products in 1,500 of its stores. This all came crashing down days later when, on April 2, 2019, CNBC reported that outgoing FDA chief Gottlieb had raised ‘concern’ over Walgreens and CVS selling CBD products. Easy come, easy go. Just notice how soon after the 2018 Farm Bill was passed that two major conventional retailers were ready to jump into the hemp and CBD market.

Some new entrants will be experts in consumer-packaged goods. Others will understand manufacturing, and many will have strong experience in distribution. Their lobbying budgets will exceed anything the industry could fathom. Some will jump in and start divisions from scratch while others will hire investment bankers to find “platform” companies that can serve as a base as they grow their new divisions. Their level of reach and competition will exceed anything the industry currently knows.

There will be some protection in limited-license markets, but license limits are legislatively enacted and with enough lobbying dollars, can be changed. Massachusetts has seen this as supermarkets and convenience store industries attacked the three-license cap for alcohol retail stores. Today that cap has increased to nine. Cannabis strategies won’t be much different. The biggest protection will come from how the legislation is designed, and that will be influenced by who has a seat at the table.

Washington moves at its own pace and while I focus little attention on DC and instead look toward where I see the change coming from, legislators prod forward slowly. The steps they take today in hearings and committees shape mindsets about legalization legislation, and that eventual framework will dictate the true future of the industry.

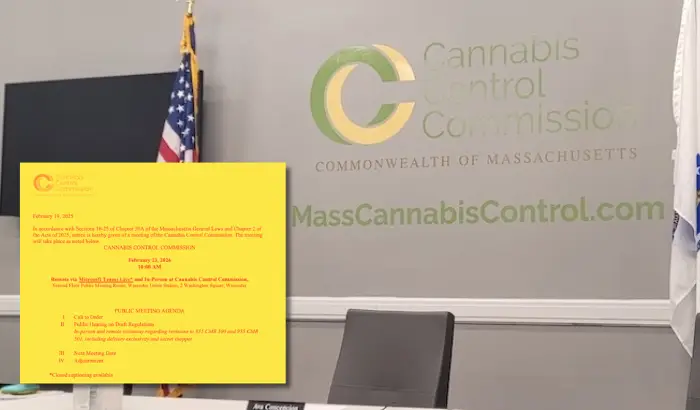

Thankfully, national cannabis organizations like National Cannabis Industry Association (NCIA) have lobbyists advocating for the existing industry and attempting to inform and educate committee members on how their decisions will impact what exists today. Former Mass Cannabis Control Commission Commissioner Shaleen Title is doing a great job covering this issue and if you aren’t following her, you should be.

Finally, if you are an indoor cultivator and indoor cultivation becomes uneconomical, how might you repurpose that space or shed it without excessive losses. Think now so you can be ready to respond later.

Each of these pivot points will happen quickly—maybe not soon, but when they happen, the impact will be abrupt.